Introduction:

Oracle Fixed Assets is fully integrated with other modules so that data input in Purchasing, Payables and Projects will flow through Fixed Assets into the General Ledger. This also means that any asset can be queried and the source information obtained by drilling down to find details of invoices. You can perform most of your transactions in Oracle Assets using just three windows: the Assets Workbench, Mass Additions Workbench, and Tax Workbench.

Additions:

The majority of assets should come via the Purchasing, Payables / Project modules using the Mass Additions / Interface Supplier Costs process. There may be a few occasions when manual additions are required. Ordinary assets can be quickly entered using Quick Additions. Detailed Additions can be used to handle more complex assets as follows:

· Assets with a salvage value.

· Assets with more than one assignment.

· Assets with more than one source line.

· Assets that Category defaults do not apply.

· Subcomponents Assets.

· Leased assets and Leasehold Improvements.

Depreciation:

Default depreciation rates can be set up for each asset category and also can be overridden in special cases. Before running depreciation you can change any field but after running depreciation you can only change asset cost and depreciation rate. You then can choose whether to amortize the adjustment or expense it.

Retirement:

You can retire an entire asset or you can partially retire an asset. You can also use Mass Retirements to retire a group of assets at one time.

Tax Book Maintenance:

Oracle Assets allows you to copy your assets and transactions from your corporate book to your tax books automatically using Initial / Periodic Mass Copy. You can create as many tax books as you need, maintain your asset information in your corporate book, and then update your tax books with assets and transactions from your corporate book.

Prepaid Services:

To record warranty and maintenance information into Oracle Assets, a purchase order must be created and the data input will flow into Payables with the proper prepaid account. Prepaid accounts are maintained in the general ledger and amortized over the period of coverage; however, the accounts charged are based on the designated account(s) for the prepaid services. The charges into the Fixed Assets account and asset category is based on the monthly charges from the monthly amortization of the prepaid services.

Capitalized Leases vs. Operating Leases:

Oracle Assets allows you to test leased assets in accordance with generally accepted accounting principles to determine whether to capitalize and depreciate your leased assets. Lease Capitalization Test: (1) the ownership of the asset transfers to the lessee at the end of the lease (2) a bargain purchase option exists (3) the term of the lease is more than 75% of the economic life of the leased asset (4) the present value of the minimum lease payment exceeds 90% of the fair market value of the asset at lease inception.

Regarding Operating leases, Fixed Assets tracks your payments under operating leases, or leases that do not meet any of the criteria, for informational purposes. You can use this information to create a schedule of future minimum payments under operating leases, information that may require disclosure in the footnotes of your financial statements.

Period-End Process:

The key components of the Period-End Process are:

· Ensure All Assets have been Properly Assigned.

· Copy New Assets Entries into Tax Books.

· Run Depreciation for the Corporate Book.

· Create Journal Entries.

· Post Journal Entries to the General Ledger.

Monday, March 31, 2008

Oracle Fixed Assets - Quick Module Overview

Oracle Fixed Assets - Requirements Analysis Questionnaire

Fixed Assets - Commonly asked Requirements Analysis Questions:

1. Do you need to track locations other than State, City, and Country for your assets? If yes, please provide alternate location values.

2. What is the Oldest Date of an asset that is Placed in Service?

3. How many assets are presently live in your system? How many are added each month?

4. Do you track tax amounts separately for federal, state, AMT, ACE etc.?

5. Please list any Prorate Conventions you use:

Common examples: Mid-month, Date in Service, Following Month

6. Please list current Asset Category information

7. What is your policy for capitalization?

8. At what point is a purchase known to be an asset? (PO, Invoice entry, later?)

9. How many locations are used and where are they located? Are any outside of USA?

10. What are your currently used depreciation methods?

11. With respect to cost centers (departments), how do you plan on tracking assets? How do you handle asset transfers?

12. How do you account for obsolete/damaged assets? What is the write-off policy?

13. Describe how assets are to be tracked and managed.

14. When are asset tags applied?

Thursday, March 27, 2008

How to create Custom Address Styles in Oracle Apps

Client – Clients who are having Global Rollouts and need for multiple address styles.

Business Case – Need to add country specific address style formats for addresses information which are stored in the different core modules of Oracle Apps including Receivables (for Customer and Remit to Addresses), Payables (Supplier and Payment Addresses), Banks (Bank Branch addresses)

Out of the box address styles - Oracle Applications provides one default and five predefined address styles. These address styles cover the basic entry requirements of many countries. The different address styles provided out of the box are:

• Default,

• Japanese,

• Northern European and Southern European,

• South American,

• United Kingdom/Asia/Australasia,

• United States

How to add a new Address Style -

Let us say the client has a Business requirement to add a new address style for ‘Canada’. The following high level steps can be followed to define this new ‘Canada’ address style.

1. Choose address style database columns for your ‘Canada’ address style.

First you need to decide (as per client’s requirements) which columns from the database you are going to use and how you are going to order them. All the seeded address styles include the following database columns and some additional columns.

• Bank Addresses

• AP_BANK_BRANCHES.ADDRESS_LINE1

• AP_BANK_BRANCHES.CITY

• AP_BANK_BRANCHES.STATE

• AP_BANK_BRANCHES.ZIP

• Customer and Remit-To Addresses

• HZ_LOCATIONS.ADDRESS1

• HZ_LOCATIONS.CITY

• HZ_LOCATIONS.POSTAL_CODE

• HZ_LOCATIONS.STATE

• Supplier Addresses

• PO_VENDOR_SITES.ADDRESS_LINE1

• PO_VENDOR_SITES.CITY

• PO_VENDOR_SITES.STATE

• PO_VENDOR_SITES.ZIP

• Payment Addresses

• AP_CHECKS.ADDRESS_LINE1

• AP_CHECKS.CITY

• AP_CHECKS.STATE

• AP_CHECKS.ZIP

For example, in the Japanese address style, the address element called Province maps onto the STATE database column and that in the United Kingdom/Africa/Australasia address style the address element called County also maps onto the STATE database column. Oracle recommends that all custom address styles also include at least the above database columns because these address columns are used extensively throughout Oracle for printing and displaying.

Note: Most reports do not display the PROVINCE, COUNTY, or ADDRESS4/ADDRESS_LINE4 database columns for addresses.

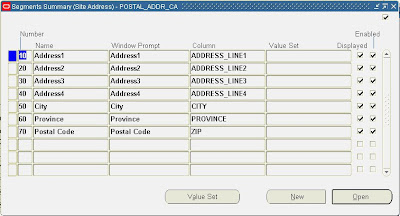

The following screenshot gives you an idea of how to setup database columns for your ‘Canada’ address style:

2. Define ’Canada’ address style to database columns using Define Descriptive Flexfield Segments Window.

Next step is to create a new context value for each of the descriptive flexfields.

Payables – Bank Address:

Payables – Site Address:

Receivables – Address:

Receivables - Remit Address Information:

3. Add address style to the address style lookup:

Add the ‘Canada’ address style name to the Address Style Special lookup so that you will be able to assign the style to countries and territories.

To add a new style to the address style lookup:

A. Using the Application Developer responsibility, navigate to Applications > Lookups > Application Object Library.

B. Query the ADDRESS_STYLE lookup.

Receivables displays all of the address styles used by Flexible Addresses.

C. Add your new ‘Canada’ address style, as follows:

D. Enable this style by checking the Enabled check box.

4. Assign the address style to the appropriate country using the Countries and Territories window.

· Using Receivable or Payables Superuser responsibility navigate to Setup > System > Countries. · Query for Country = ‘Canada’

· Attach the ‘Canada’ Address Style created to the Canada Country

· Save the record

5. This completes the setup for the new ‘Canada’ address style, now you can use this new address style while adding new Canada Customers, Suppliers etc. See screenshot below on how the Customer Form displays the new ‘Canada’ address style:

Click on the Address filed and you will get a popup window with the new ‘Canada’ address style:

Sunday, March 23, 2008

Designing Simple Forms Personalizations for Functional Consultants

Forms Personalization: I kept reading about this amazingly new feature called 'Forms Personalization' but what really bothered me was almost all the articles / whitepapers had the targeted audience as ‘Admin / Developer’ who have some ‘knowledge of Oracle Developer, PL/SQL, Coding Standards and API’s’.

This really caught my attention and I spent about 2 hours trying to figure out what can a Functional Consultant like myself get out of this new feature. Good news is that you don’t need to have any technical knowledge to design some simple personalizations. So in this article, I have tried to explore some easy to design personalization’s which the Functional Consultants can easily build and test.

Why personalization’s are handy – Since Oracle Apps is a pre-built product, most of the clients would like to remove/ rename, change default values of some of the fields, buttons, tabs etc. Traditional method of getting all the above ‘extensions’ done was to ‘customize’ the form (by customizing the custom.pll) which was generally protected during upgrades / patching. Luckily most changes traditionally done using cutom.pll can be accomplished using Forms Personalization.

Functional Folks - How to quickly get started – The ‘personalize’ menu can be found at Help -> Diagnostics -> Custom Code -> Personalize. To prevent unauthorized users from changing the look and behavior of forms, please use the following profile options:

Utilities: Diagnostics = Yes / No

Hide Diagnostics = Yes / No

Four sections to define a Personalization – There are four sections in the define forms personalization form:

Rules Header – This is where you enter the rules and rule descriptions in plain English. You can sequence these rules using a number and enable/ disable any one rule by using the Enabled checkbox.

Conditions – Consists of Trigger Event: the event within the form that causes invocation of the rule, Trigger object: the context for the trigger event, such as a

particular block or item, Condition: an optional SQL fragment that, when it evaluates to TRUE, allows the rule to execute.

Context or Scope - The Scope is evaluated based on the current runtime context to determine if a Rule should be processed or not. The Scope can be at the Site, Responsibility, User, or Industry level. Each Rule can have one or more Scopes associated with it.

Actions – Determines what the personalization does when the condition and context are true. Various types of actions available include ‘Property’, ‘Message’, Builtin’ or a ‘Special’. Based on the type, additional definition

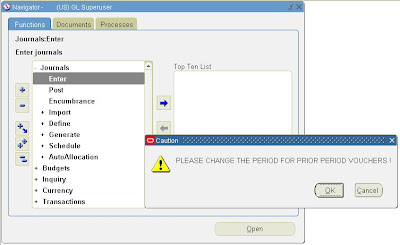

Real world examples you can try – One of my banking client wanted the Journal Enter form to be customized for the following business rules:

1. Change the ‘Journal’ prompt to display ‘Voucher’

2. Journal description should always be in UPPER CASE

3. Do not display the Budget field, as budgets were not implemented

4. Note to display warning to change Period for prior period Journals.

The following screenshots explain how these four business requirements were implemented using Forms Personalization:

1. Change the ‘Journal’ prompt to display ‘Voucher’:

2. Journal description should always be in UPPER CASE:

3. Do not display the Budget field, as budgets were not implemented:

4. Note to display warning to change Period for prior period Journals:

Journal Entry Form after Personalizations:

When opening the form, the following note gets displayed:

Journal Entry Form after Personalization (Note - Voucher, Budget not displayed and Description in Upper Case:

Thursday, March 20, 2008

General Ledger Implementation Considerations - Sets of Books (Ledger for 12i) and Chart of Accounts

Set of Books (Ledger for 12i):

Set of books determines the functional Currency, Chart of account structure, and accounting Calendar for each company or group of companies, which are known as the 3 C's.

You need to create and set up one or more sets of books. The number of books you set up depend on various factors, such as:

Ø Whether you have multiple subsidiaries using different calendars, charts of accounts, and currencies requiring multiple sets of books

Ø Whether you have multiple subsidiaries that share the same calendar, chart of accounts, and currencies that allow them to share the same set of books

Ø Your organizational requirements or government reporting requirements.

General Ledger provides you with the flexibility to manage your financial information within any company structure. One can maintain multiple companies with similar or different accounting structures, and consolidate their results for meaningful financial reporting.

Chart of Accounts:

Chart of accounts uses Key Flexfield (Accounting Flexfield) that, comprises of Segments, Value sets, Values and Code Combination ID.

Defining the Chart of accounts:

Planning the Chart of accounts structure is the most important activity involving the structure, segments, segment validation and additional features. Analyze the organizational structure and the dimensions of the business before designing the Chart of accounts. By carefully evaluating the business needs, design the chart of accounts to take advantage of General Ledger’s flexible tools for recording and reporting the accounting information.

The account structure can comprise 30 segments with a maximum character length of 275 for the entire String. Each string of multiple-segments is called a code combination and stores a code combination ID based on which balances are maintained in GL. An accounting chart normally consists of Company code, Line of Business, Cost center, Natural Account, Intercompany and Future.

How to define Key Flexfield Structures like Chart of Accounts:

Ø Define descriptive information and validation information for each segment.

Ø Determine the appearance of your key flexfield window, the number and order of the segments, and the segment descriptions and default values.

Ø Freeze flexfield definition and save the changes once set up or when the structures/segments are modified. On saving, Flexfield compiles automatically to improve on–line performance.

Ø Compile the flexfield every time when the changes are made to this form, including enabling or disabling cross–validation rules and when the changes are made to the shorthand aliases window.

Ø Oracle Applications submits one or two Concurrent requests to generate database views of the flexfield combinations table.

Ø The flexfield changes immediately after freezing and recompiling. However, the changes affect other users only after they change responsibilities or exit the application and sign back on.

Determine the Chart of Accounts Structure That Best Suits Your Organization:

Ø Examine the organization structure to identify how performance and profitability are normally measured

Ø Also multiple organizational structures may be needed to allow views of the organization from multiple perspectives. Summary accounts can be used to roll up details.

Ø Visualize each segment of the account as a unit dimension of the business. Combine units that are based on similar dimensions to avoid using multiple segments that measure the same dimension.

Ø Identify the functions, products, programs, funding sources, regions, or any other business dimensions that are to be tracked

Ø Determine the reporting needs.

Consider the following questions before defining the COA structure:

Ø What information will better help one to manage one’s organization?

Ø What are the different ways in which one can look at one’s operations?

Ø What kinds of reports do managers ask for?

Ø What reports one prepares now with some difficulty?

Ø What reports are provided by other financial information systems?

Ø What statistical reporting does one want to perform?

Ø Is project reporting needed?

Ø At what levels of detail does one produce reports?

To Determine Your COA Segment Needs:

Ø Determine the segment that captures the natural account, such as assets, liabilities, expenses, and so on.

Ø Define a separate Accounting Flexfield segment for each dimension of your organization on which you want to report, such as regions, products, services, programs, and projects.

Ø Group similar business dimensions into one segment. This allows a more simplified and flexible account structure For example, you only need one segment to record and report on both districts and regions. Because regions are simply groups of districts, you can easily create regions within your district segment by defining a parent for each region with the relevant districts as children. Use these parents when defining summary accounts to maintain account balances and reporting hierarchies to perform regional reporting.

Flexfield Concepts

Flexfield in Oracle Apps - Oracle Apps forms and reports are designed to be flexible and to accommodate many kinds of business rules for a wide variety of situations. Along with the innumerable predetermined fields that appear on each screen, most screens can accommodate the entry of additional information through the use of flexfields.

Types of Oracle Apps Flexfields:

1. Key Flexfield:

1.1 Most organizations use ”codes” made up of meaningful segments (intelligent keys) to identify general ledger accounts, part numbers, and other business entities. Each segment of the code can represent a characteristic of the entity. Oracle Applications store these ”codes” in key flexfields.

1.2 Key flexfields are flexible enough to let any organization use the code scheme they want, without programming. One has to decide what each segment means, what values each segment can have, and what the segment values mean. An organization can define rules to specify which segment values can be combined to make a valid complete code (also called a combination). One can also define relationships among the segments.

1.3 Key flexfields are dynamic in the sense that they are used throughout the Applications to uniquely identify information - GL accounts, inventory items etc, that every business needs to keep track of.

2. Descriptive Flexfield:

2.1 Descriptive Flexfields (DFFs) enable to capture additional pieces of information from transactions entered into Oracle Applications. Descriptive flexfields provide customisable ”expansion space” on your forms.

2.2 One can use descriptive flexfields to track additional information, important and unique to your business that would not otherwise be captured by the form.

2.3 Each field or segment in a descriptive flexfield has a prompt, just like ordinary fields, and can have a set of valid values.

2.4 An organization can define dependencies among the segments or customize a descriptive flexfield.

Flexfield Concepts:

1. Segment:

@ A single sub–field within a flexfield.

@ Represented in the database as a single table column.

@ Usually describes a particular characteristic of the entity identified by the flexfield

@ Determines the structure of the Key flexfield (say chart of accounts).

@ Each segment requires a value set to be defined and assigned.

@ One has to be very clear on how many segments are required, their order and validation.

These decisions affect the definition of value sets and their values.

2.Value, Validation (Validate), Value set:

@ Oracle Application Object Library uses values, value sets and validation tables as important components of key flexfields, descriptive flexfields, and Standard Request Submission. The end user enters a segment value into a segment while using an application.

@ Generally, the flexfield validates each segment against a set of valid values (a ”value set”) that are usually predefined. One can share value sets among segments in different flexfields, segments in different structures of the same flexfield, and even segments within the same flexfield structure. Value sets can be shared across key and descriptive flexfields.

Because the conditions one specifies for the value sets determine what values to be used with them, both the values and the value sets should be planned at the same time.

3. Structure:

A flexfield structure is a specific configuration of segments. If you add or remove segments,

or rearrange the order of segments in a flexfield, you get a different structure. You can

define multiple segment structures for the same flexfield (if that flexfield has been built to

support more than one structure).

Wednesday, March 19, 2008

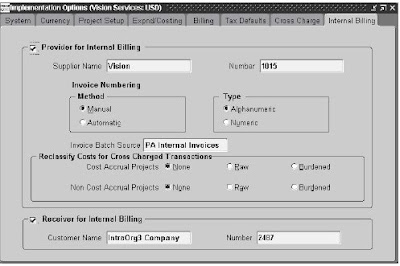

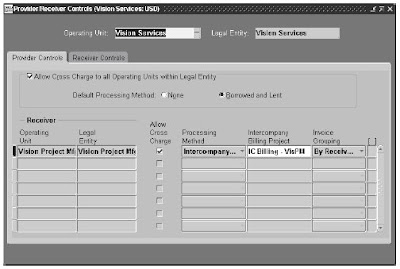

Intercompany Setups and Sample Transaction Processing using Oracle Projects

Business Case – Canadian employee travels to US to work on a US project. Canadian employee needs to bill time and expenses for the US Project and the US Project Manager has to pay the Canadian office for the Canadian employees work on the US project.

Setups to support Intercompany Billing:

The setup steps are divided into the following phases:

Global Setup:

• Define transfer price rules

• Define transfer price schedules

• Define additional expenditure types, agreement types, billing cycles, invoice formats, and supplier types

• Define an internal supplier

• Define an internal customer

Operating Unit Setup:

• Define supplier sites for the internal supplier (receiver)

• Define bill to and ship to sites for the internal customer (provider)

• Define internal billing implementation options (each operating unit)

• Define internal tax codes for Payables invoices (receiver)

• Define an agreement for intercompany billing projects

• Dene a Project Type for Intercompany Billing Projects

• Dene Project Templates for Intercompany Billing Projects

• Dene Intercompany Billing Projects (receiver)

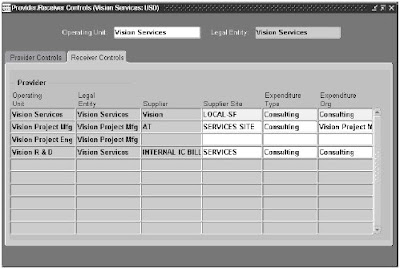

• Dene Provider and Receiver Controls

Receiver Controls:

Steps to process Intercompany Transactions for Contract Projects (Canada = Provider OU, US = Receiver OU):

1. Receiver OU - Create/ Approve Contract. Enter "Employee Bill Rate and Discount Overrides" at the Project/ Task Level for Provider Employee’s

2. Provider OU - Employee enters time against Receiver OU Project

3. Provide OU - Time Card is approved

4. Provider OU - Employee enters & submits expenses against Receiver OU Project

5. Provider OU - Expense is approved are processed in AP

6. Provider OU - Run Transaction Import (Timecards), Interface Expense Reports to PA, Distribute Labor Costs

7. Receiver OU - Generate Draft Revenue

8. Provider OU - Review Proj Func Burdened, Labor, Expense Report Cost/ Accounts

9. Receiver OU - Verify Labor Revenue A/C, Expense Revenue A/C

10. Receiver OU - Run Project WIP Report (on demand), Project Manager reviews WIP Report and Attests Revenue

11. Receiver OU - Generate Draft Invoice, Approve & Release Draft Invoice

12. Receiver OU - Interface to AR, Review BPA Invoice, Run BPA Master Print Program to print invoice, Mail Invoice to Customer

13. Provide OU – Generate, Approve and Release Intercompany Invoice

14. Provide OU – Interface Intercompany Invoice to Receivables

15. Provide OU - Verify Intercompany Receivables / Revenue Account, Invoice Tax Account

16. Receiver OU – Run Payables Intercompany Invoices Interface Import, AP Post , Payables Transfer to GL, Validate Accounts

Thursday, March 13, 2008

SOX, SOD and Oracle Apps

Why SOX Compliance is critical - Top Ten IT Control Deficiencies ( Source: Ken Vander Wal, Partner, National Quality Leader, E&YISACA Sarbanes Conference , 4/6/04):

1.Unidentified or unresolved segregation of duties

2.Operating System access controls supporting financial applications or Portal not secure

3.Database access controls supporting financial applications not secure

4.Development staff can run business transactions in production

5.Large number of users with access to “super user” transactions

6.Former employees or consultants continue to have system access

7.Posting periods not restricted within GL application

8.Custom programs, tables and interfaces are not secured

9.Procedures for manual processes do not exist or are not followed

10.System documentation does not match actual process

Segregation of Duties (SOD) Definition:

Segregation of duties (SOD) provides the assurance that no one individual has the physical and system access to control all phases of a business process or transaction: from authorization to custody to record keeping. A person or group has too much access or authority – resulting in risk exposure to the business.

SOD Examples:

Organizations in Oracle Apps

I.Organization in Oracle Applications

Definition of Organization:

Organization is an entity to which different types of transactions, that are recorded, are identified. A transaction is recorded for a particular kind of Entity, in other words, Organization.

Need for Organization:

1.Use a single installation of any Oracle Applications product to support any number of organizations, even if those organizations use different sets of books.

2. Define different organization models

3. Support any number of legal entities within a single installation of Oracle Applications.

4. Secure access to data so that users can access only the information that is relevant to them.

5. Sell products from a legal entity that uses one set of books and ship them from another legal entity using a different set of books, and automatically record the appropriate intercompany sales by posting intercompany accounts payable and accounts receivable invoices.

6. Purchase products through one legal entity and receive them in another legal entity.

II. Types of Organizations

The types of Organizations are based on the business needs of an enterprise. These also depend on the purpose for which an Organization is created. An Organization could be Internal or External. Broad grouping of Organization is as follows:

A. Business Unit

B. Headquarters

C. Divisions / Departments / Branch

D. Plant / Operations Unit

E. Product Lines

These are considered for reporting purposes. An External Organization could be Agents or Tax Authorities. By categorizing an Organization as External, employees cannot be assigned.

Classification of Organizations:

The Classification of Organizations decides the data flow of your Enterprise. The following are the classifications to which an Organization can fall into.

1. Set of Books:

If the business need requires having more than one Set of Books, then the installation automatically becomes Multi Organizational. Oracle General Ledger secures transaction information (such as journal entries and balances) by set of books. When you use Oracle General Ledger, you choose a responsibility that specifies a set of books.

2. Business Group:

The Business Group represents the highest level in the Organizational Structure. All the human resources information is stored at this level. The employees are assigned at this level. All the Sets of Books that are attached to a Business Group share the employees within that Business Group.

3. Legal Entity:

This is an Organization which represents the legal Company for which the fiscal and tax reports are prepared. This is presently available in the United States Federal Reporting context.

4. Balancing Entity:

This is the accounting entity for which the financial reports are prepared. This is the mandatory segment in the Accounting Flexfield in Oracle General Ledger. There could be multiple companies that come under the same Legal Entity and each company’s financial statements match tally within itself.

5. Operating Unit:

An Operating Unit is generally your branch office or a sales division or a department. The subledgers like Payables, Receivables, Purchasing and Order Management are configured based on operating unit. The users attached to this subledger would see the data for only the operating that has been attached to the respective responsibility.

6. Inventory Organization:

This is the Organization that tracks the inventory transactions and balances and the activities of an organization that manufactures or distributes or stores products. Manufacturing units, warehouses, distribution offices are normally classified into this category. Oracle Manufacturing Suite modules are based on Inventory Organizations.

7. HR Organization:

This class of Organization represents the work structure of an enterprise. They usually represent the functional management, or reporting groups that exist within a business group.

8. Project Organizations:

These classes of Organizations are used in Oracle Projects to monitor and transact on different kinds on projects, created in Oracle Projects Suite. This document discusses in detail on Project Organizations in the coming sections.

9. Asset Organizations:

This is a new class of Organization introduced in Release 11i. An asset organization is an organization that allows you to perform asset–related activities for a specific Oracle Assets corporate depreciation book. Oracle Assets uses only organizations designated as asset organizations

III. Setup Organizations

The following are the simplified setup steps to be followed to create an organization structure in a new environment:

1) Define Organization Structure.

· This is a pen and paper process of setting up the organizations structure.

· Assign organization classification in the following order:

(1) Legal entities, (2) Operating units, and (3) Inventory organizations.

2) Define Sets of Books. Use Define Set of Books window to enter a set of books. Responsibilities used to assign sets of books:

a) Assets - Setup -> Financials -> General Ledger -> Set of Books

b) General Ledger - Setup -> Set of Books -> Define

c) Inventory - Setup -> Financials -> Books

d) Payables - Setup -> Set of Books -> Define

e) Purchasing Receivables - Setup -> Organizations -> Set of Books

f) Receivables - Set Up -> Financials -> Books

g) Government General Ledger - Setup -> Set of Books -> Define

3) Define Organizations. Use Define Organizations window to define organizations. · Responsibilities used to assign organizations:

i) Inventory - Setup -> Organizations -> Organizations

ii) Purchasing - Setup -> Organizations -> Organizations

iii) Order Entry / Shipping - Set Up -> Organizations -> Organization

iv) Projects - Setup > Human Resources -> Organizations -> Define

v) Receivables - Set Up > System -> Organization

vi) Government Purchasing - Setup -> Organizations -> Organizations

vii) Government Receivables - Set Up -> System -> Organization ·

Define Business Groups. (Optional)

· Define if you have multiple business groups or do not use default business group.

· You must have at least one business group. Oracle Applications supplies default business group, Setup business Group (fresh install).

· If you define business group next step must be to associate business groups with a responsibility and verify the HR: Business Group profile option. (See step 5.)

4) Define Organization Relationships. Use the Define Organization window to define organization relationships by assigning classifications to each organization.

a) Classification of an organization can be any combination in the following order: i) Legal entities, ii) Operating units, and iii) Inventory organizations.

b) Legal entities must have a location specified. (Zoom to Define Locations window.)

5) Define Responsibilities. Use the Define Responsibility window to define responsibilities for each operating unit. Responsibilities used to assign responsibilities:System Administrator - Security -> Responsibility -> Define If you have multiple business groups, you must associate each responsibility with one and only one business group. Use the HR: Business Group system profile option to associate a responsibility with a business group.

6) Set MO:Operating Unit Profile Option for Each Responsibility.

MO:Operating Unit profile option must be set.

· System Administrator - Profile -> System

· Set profile option to appropriate operating unit id (ORG_ID). You must set the default-operating unit setting MO:Operating Unit at the site level.

7) Run Convert to Multiple Organization using Adadmin utility. Process replicates seed data to all operating units that have been defined. This step is irreversible. Adadmin will fail if previous steps have not been completed. Concurrent managers must be down and no one should access the database. If adadmin fails during conversion and you are prompted to proceed as if successful, never select Yes, as the conversion process has already begun, and steps that may be missed during the conversion process will need to be manually created and be difficult, costly and timely to recreate.

8) Define Inventory Organization Security (Optional). Restricts manufacturing users to specific organizations.

9) Change Order Entry Profile Options (Optional). For Release 11: OE:Item Validation Organization profile option is set a responsibility level if operating units have different item validation organizations.

For Release 11i: Attach the submenu ‘ONT_SETUP’ and function ‘Setup OM parameters’ to any main menu (AR / OM). Switch to AR / OM Responsibility and

1. Open OM_Parameters Menu.

2. Give a Name for OPERATING UNIT and

3. For Item Validation Organization, Select Inventory Organization

4. Save your work

10) Update Profile Options Specific to Operating Units.

Set profile options at the responsibility level e.g.:i) AR: Receipt Batch Source ii) AR: Transaction Batch Source iii) OE:Item Validation Organization – Only for Release 11 iv) OE: Set of Books v) GL: Set of Books Sequential Numbering

Responsibilities used to assign profile options:System Administrator - Profile -> System. Refer to individual Oracle Financial Applications Products User's Guides for specific information on profile options that need to be set.

11) Set up Oracle Applications Products. OE, PA, PO, AR and Sales Compensation must be set up for each operating unit it they the product groups are to be used. FA, GL INV and the rest of the Oracle Manufacturing product do not need to be set up for each operating unit.

12) Secure Balancing Segment Values by Legal Entity. (Optional) Use the Define Security Rule window to create rules that secure data entry of balancing segment values for each legal entity.· Security rule elements specify a range of values to be included or excluded. Use the Assign Security Rules window to assign the same rule(s) to all responsibilities associated with the legal entity's operating units. Define additional rules and assign them to all responsibilities associated with relevant operating units.

13) Run the Setup Validation Report to Identify Setup Problems. Data for disabled fields on Enter Customer and Enter Supplier Window must be deleted.

14) Header information is shared across operating units and if you do not choose to delete the data, you must edit the database manually. All responsibilities in one operating unit must share the same profile option values and sequence numbering option.

Create Locations:

Use the Define Location window to define names and addresses for the locations you use within your enterprise. You define each location once only. This saves you time if you have multiple organizations with the same location. You should define locations for your legal entities and inventory organizations. Oracle Applications products use locations for requisitions, receiving, shipping, billing, and employee assignments.

Cross Business Groups

With Cross Business Group Access (CBGA) the business group now exists at one level lower and you can access organizations, resources and projects across business groups within a hierarchy

IV.Organizations in Projects Accounting

Projects can be controlled based on the Organization Classifications. The following are the basic classifications:

Project / Task Owning Organization. Project/Task Owning Organizations are organizations that can own projects and/or tasks in the operating unit.

Project Expenditure/Event Organization. Expenditure/Event Organizations are organizations that can own project events (labor and non–labor) and can incur expenditures for projects in the processing operating unit.

Project Invoice Collection Organization. If your business decentralizes its invoice collection within an operating unit, you must enable the Project Invoice Collection Organizations classification for each organization in which you want to process invoices.

Project Manufacturing Organization is one that links your Project between Inventory Organization and Projects. This is a new feature in Release 11i.

Billing Schedule Organizations are organizations that have their own billing schedules. Any organization in the operating unit’s business group can have its own billing schedules.

Resource Organizations are organizations that own resources and/or resource budgets. Any organization in the operating unit’s business group can own non–labor resources. Only HR organizations can have employees assigned to them. Oracle Projects does not have a classification requirement for an organization to own non–labor resources.

Relationships between Organizations

1. Legal Entities Post to a Set of Books

2. Operating Units Are Part of a Legal Entity

3. Inventory Organizations are Part of an Operating Unit

4. Inventory Organization Determines Items Available to Order Management

5. Inventory Organization Determines Items Available to Purchasing

6. Project Organizations are attached to Business Group

7. Employee availability within Operating Units depends on the Business Group to which the OU is attached.

8. A Project Organization has to be classified as HR Organization if employees are planned to be assigned.

9. A Project Manufacturing Organization should have an additional classification of Inventory Organization to be able to handle inventory items.

V. Organization Hierarchy

In Oracle Applications, organization hierarchies show reporting lines and other hierarchical relationships among the organizations in your enterprise. An organization hierarchy illustrates the relationships between your organizations. When you define a hierarchy, you tell Oracle Projects which organizations are subordinate to which other organizations. The topmost organization of an organization hierarchy is generally the business group.

In addition to the primary reporting hierarchy, you can set up in as many other organization hierarchies as you need. You can create as many organization hierarchies as you need for different reporting and processing needs, and you can create multiple versions of an organization hierarchy. Oracle Projects uses the hierarchy version to determine which organizations are used for reporting and processing.

The following organization hierarchy versions are assigned in Oracle Projects:

A Project/Task Owning Organization Hierarchy Version is assigned to each operating unit.

An Expenditure/Event Organization Hierarchy Version is assigned to each operating unit.

A Default Reporting Organization Hierarchy Version is assigned to each operating unit. This hierarchy version can be overridden at reporting time.

A Project Burdening Hierarchy Version is assigned to each business group.

Start Organization

This is the branch of your organization hierarchy that you specify in Oracle Projects as the top of your hierarchy. When you choose a start organization as a reporting parameter, the start organization and all organizations below it are included in the report.

You create organization hierarchies in the Organization Hierarchy window. Always define hierarchies from the top organization down. You must define the top organization in the hierarchy, and at least one organization subordinate to it. The organization hierarchy you define here appears in a list of values in the Implementation Options window.

To create an Organization Hierarchy,

1. Enter a unique name for the hierarchy, and check Primary if it is your main reporting hierarchy.

2. Enter the version number and start date for the hierarchy. You can copy an existing hierarchy.

3. Query the top organization name in the Organization block.

4. In the Subordinates block, select the immediate subordinates for the top organization.

5. To add organizations below one of these immediate subordinates, check the Down check box for the organization. The Organization block now displays the organization you selected. You can add subordinates to this organization. To return to the previous level, check the Up check box.

To change the hierarchy

1. Query the name of the hierarchy.

2. In the Version field, use the Down Arrow to move through existing versions of the hierarchy until you reach a version number for which no other data appears. Enter the start date for the new version.

Note: Overlapping versions of a hierarchy cannot exist. Whenever you enter a new version of a hierarchy, the system automatically gives an end date to the existing version. Oracle HRMS retains the records of obsolete hierarchies, so you do not lose any historical information.

3. Query the top organization name in the Organization block.

4. In the Subordinates block, select the immediate subordinates for the top organization.

5. To add organizations below one of these immediate subordinates, select the Down check box for the organization. The Organization block now displays the organization you selected. You can add subordinates to this organization. To return to the previous level, select the Up check box.

Project/Task Owning Organization Hierarchy

You assign a project/task owning organization hierarchy to the operating unit to control which organizations can own projects and tasks. To own projects and/or tasks in the operating unit, an organization must have all of the following characteristics:

1.The organization must belong to the project/task organization hierarchy assigned to the operating unit.

2. The organization must have the project/task owning organization classification enabled.

3. The project type class must be permitted to use the organization to create projects. This permission is determined when you define the organization.

4. The organization must be active as of the system date.

Expenditure/Event Organization Hierarchy

You assign an expenditure/event organization hierarchy to the operating unit to control which organizations have the following capabilities:

1. incur expenditures

2. own project events

3. be assigned to a resource list as a resource

Default Reporting Organization Hierarchy

You specify an organization hierarchy and version to indicate which organization hierarchy of a Business Group you want Oracle Projects to use as the default reporting organization hierarchy.

You specify a start organization to indicate which branch of your organization hierarchy you want Oracle Projects to recognize as the top of your hierarchy for reporting purposes. If you want to use your entire organization hierarchy, your top organization (generally the business group) is the start organization. For example, if you define your organization hierarchy with four divisions under the top organization, you can specify one division as the start organization. Oracle Projects consequently recognizes only that division and its subordinate organizations as its default reporting hierarchy.

Project Burdening Organization Hierarchy

For each Business Group, you specify a Project Burdening Organization Hierarchy and Version. Oracle Projects uses the Organization Hierarchy/Version to determine the default Burden Multiplier when compiling a Burden Schedule.

To specify project burdening hierarchies:

1. Select an Oracle Projects responsibility with access to the Organization window associated with the Business Group for which you are entering Legal Entities and Operating Units.

2. Navigate to the Organizations window (Setup > Human Resources > Organizations > Define).

3. Define an organization or query organizations that you defined as a business group. You must define the hierarchy before you designate it as the project burdening hierarchy.

Depending on your enterprise organization structure and business process, it is possible for the Project Burdening Hierarchy Version to be different from the Project/Task Organization Hierarchy Version, Expenditure/Event Organization Hierarchy Version, or Default Project Reporting Organization Hierarchy Version that you defined for any operating units associated with the business group. The Cost Distribution processes will not burden expenditures for expenditure organizations that are not in the Project Burdening Hierarchy.

If you add a new organization to the Project Burdening Hierarchy Version

If you add a new organization to the Project Burdening Hierarchy Version, you must

1. add new burden multipliers for that organization in the appropriate burden schedules, or

2. use the multipliers inherited from the parent organization as the burden multipliers for the organization

If you want to add burden multipliers to a particular schedule version for the organization, you need to compile the affected schedule version. If you use the parent organization multipliers, you must submit the PRC: Add New Organization Burden Compiled Multipliers process. This process adds multipliers for this organization to all burden schedules versions for which you did not explicitly add multipliers. If you do not run this process, you will encounter a rejection reason of ’Cannot find compiled multiplier’ for transactions charged to this organization.

VI.Profile Options

HR:Business Group

Use this profile option to attach a Business group.

HR: Security Profile

Use this profile option to point your responsibility to a specific business group.

HR: User Type

Use this profile option to classify the type of HR installation your enterprise has

HR: Cross Business Group

Use this profile option to enable Cross Business Group access functionality.

MO: Operating Unit

Use this profile option to control which operating unit a particular responsibility corresponds to only if you have implemented multiple organization support.

Multi-Org 101

Multi-Org Architecture:

1. Before Multi-Org – Need one server for every set of Books implemented

2. With Multi-Org – One server, multiple sets of Books

3. The multiple organization structure simply partitions key tables to allow for an ORD_ID number per row

3.1 Used to provide security and data segregation.

4. Criteria used to partition tables includes:

4.1 The table contains a GL Account Code (code combination ID).

4.2 There is a business reason for the table to be partitioned (for example, the entity should not be shared).

4.3 The table contains transaction data.

4.4 The table is an interface table where data being loaded is partitioned.

4.5 The table includes a foreign key to a partitioned table and is accessed independently (in other words, not just as a child of a partitioned table).

Centralized Processing:

1. Centralized GL, AP, AR, PO, OE, and PA

1.1 Clients can use your balancing segment within your Chart of Accounts to segregate legal entity data

2. Decentralized GL, AP, AR, PO, OE, and PA

2.1 Client must have an Operating Unit for each group

Multi-Org Relationships:

1. Business Group, Legal Entity and Master Inventory Organization are all separate structures

2. Business Group and Legal Entity are linked through Responsibilities using the System Profile Options

3. Legal Entities and Inventory Organizations are linked by Set of Books

Why do you need Multi_org?

1. We only have one Set of Books, Business Group, Legal Entity and Operating Unit. Why Run Multi-Org?

1.1 Future growth and acquisitions

1.2 Change in company directions

1.3 Conversion from single org to multi-org is

1.3.1 Difficult in Release 10

1.3.2 Required in Release 11i and 12i

High Level Multi-Org Setup Steps:

1. Develop the organization structure

2. Define sets of books

3. Define organizations (Business Group, Legal Entity, Operating Unit, Inventory Orgs)

4. Define organization relationships

5. Define responsibilities

6. Update Profile Options Specific to Operating Units

7. Run the Setup Validation Report (recommended)

Multi-Org model as it relates to organizations:

· A ‘Business Group’ is the highest level of the structure and has no accounting impact. The ‘Business Group’ determines which employees will be available to ‘Sets of Books’ and ‘Operating Units’ related to that ‘Business Group’

· ‘Set of Books’ is the highest level which impacts the accounting side of the business

· ‘Set of Books’ is associated with a single ‘Business Group’, multiple ‘Sets of Books’ may be associated with a single ‘Business Group’

· Each ‘Set of Books’ may have a different chart of accounts structure, calendar or functional currency

· Each ‘Legal Entity’ is associated to a single ‘Set of Books’, multiple ‘Legal Entities’ may be associated with the a single ‘Set of Books’

· Each ‘Operating Unit’ is associated with a single ‘Legal Entity’, multiple ‘Operating Units’ may be associated with a single ‘Legal Entity’

· An ‘Inventory Organization’ may be associated with any ‘Operating Unit within the same ‘Set of Books’

New Operating Units - Critical Steps:

1. Oracle provides the seed data replication program as a concurrent program

2. May need to run the Replicate Seed Data process if seeded data does not replicate correctly

3. Remember to set up Responsibilities and System Profile Options (GL: Sets of Books and MO: Operating Unit) for each new OU defined

High level Workflow Customization Approaches

Approach 1. Preserve the original workflow, with a different name. Then customize the original workflow.

Approach 2.Customizing the original (even if you use the appropriate workflow protection) often results in the flow being blown away when patches are applied. It also means that the fact a flow is customised difficult to tell. So where possible we create new top level (runnable processes) by copying them and renaming them and the same for all lower levels that are customised. With the PO approval (and several other flows inc accopunt generator flows) this is the way to go because you can define the startup process in the application.

So for reasons of patch protection and clearly visable customisations always create new top level processes. All new or customised functions, notifications etc are also copied and renamed.

Approach 3.One other point to consider is there are workflows that you cannot rename. Therefore, you will have to customize the ORIGINAL. Some of these workflows were in the PO module.

Approach 4.The Best way to Customize the workflows is as follows.

1)Take the seeded workflow

2)Right click on the Item TYpe and create a new Item TYpe .

3)OPen Seeded Workflow in other window .

4)Copy and paste ATTRIBUTES , NOTIFICATIONs etc from the the seeded workflow to the Newly named workflow .

5)Verify the workflow

6)Customize the new workflow according to your need.

Approach 5.If you make a copy of the item type itself, you will also need to customize your form which calls the workflow, since the internal name is hard coded in the application.

In case of an 'Account Generator' workflow, you can make a copy of the top level process 'Generate Default Account', customize it and other processes under it and then call it by setting the internal name of this process under Application =>

Flexfield => Key => Accounts for the specific account generator.

As a general rule, do not decide to customize forms code for workflow related changes. To retain your customizations, upload your customized workflows whenever any patches are applied.

Approach 6.Some workflows do not allow you to use the copy approach so you have to modify the standard process. Examples where you can use the copy are:

1. All account generator workflows

2. PO Approval

3. Requisition Approval

Examples where you cannot do this:

1. PO Create documents

2. Expense Report Approval

Wednesday, March 12, 2008

Oracle AIM Document Templates

1. Business Process Architecture (BP)

BP.010 Define Business and Process Strategy

BP.020 Catalog and Analyze Potential Changes

BP.030 Determine Data Gathering Requirements

BP.040 Develop Current Process Model

BP.050 Review Leading Practices

BP.060 Develop High-Level Process Vision

BP.070 Develop High-Level Process Design

BP.080 Develop Future Process Model

BP.090 Document Business Procedure

2. Business Requirements Definition (RD)

RD.010 Identify Current Financial and Operating Structure

RD.020 Conduct Current Business Baseline

RD.030 Establish Process and Mapping Summary

RD.040 Gather Business Volumes and Metrics

RD.050 Gather Business Requirements

RD.060 Determine Audit and Control Requirements

RD.070 Identify Business Availability Requirements

RD.080 Identify Reporting and Information Access Requirements

3. Business Requirements Mapping

BR.010 Analyze High-Level Gaps

BR.020 Prepare mapping environment

BR.030 Map Business requirements

BR.040 Map Business Data

BR.050 Conduct Integration Fit Analysis

BR.060 Create Information Model

BR.070 Create Reporting Fit Analysis

BR.080 Test Business Solutions

BR.090 Confirm Integrated Business Solutions

BR.100 Define Applications Setup

BR.110 Define security Profiles

4. Application and Technical Architecture (TA)

TA.010 Define Architecture Requirements and Strategy

TA.020 Identify Current Technical Architecture

TA.030 Develop Preliminary Conceptual Architecture

TA.040 Define Application Architecture

TA.050 Define System Availability Strategy

TA.060 Define Reporting and Information Access Strategy

TA.070 Revise Conceptual Architecture

TA.080 Define Application Security Architecture

TA.090 Define Application and Database Server Architecture

TA.100 Define and Propose Architecture Subsystems

TA.110 Define System Capacity Plan

TA.120 Define Platform and Network Architecture

TA.130 Define Application Deployment Plan

TA.140 Assess Performance Risks

TA.150 Define System Management Procedures

5. Module Design and Build (MD)

MD.010 Define Application Extension Strategy

MD.020 Define and estimate application extensions

MD.030 Define design standards

MD.040 Define Build Standards

MD.050 Create Application extensions functional design

MD.060 Design Database extensions

MD.070 Create Application extensions technical design

MD.080 Review functional and Technical designs

MD.090 Prepare Development environment

MD.100 Create Database extensions

MD.110 Create Application extension modules

MD.120 Create Installation routines

6. Data Conversion (CV)

CV.010 Define data conversion requirements and strategy

CV.020 Define Conversion standards

CV.030 Prepare conversion environment

CV.040 Perform conversion data mapping

CV.050 Define manual conversion procedures

CV.060 Design conversion programs

CV.070 Prepare conversion test plans

CV.080 Develop conversion programs

CV.090 Perform conversion unit tests

CV.100 Perform conversion business objects

CV.110 Perform conversion validation tests

CV.120 Install conversion programs

CV.130 Convert and verify data

7. Documentation (DO)

DO.010 Define documentation requirements and strategy

DO.020 Define Documentation standards and procedures

DO.030 Prepare glossary

DO.040 Prepare documentation environment

DO.050 Produce documentation prototypes and templates

DO.060 Publish user reference manual

DO.070 Publish user guide

DO.080 Publish technical reference manual

DO.090 Publish system management guide

8. Business System Testing (TE)

TE.010 Define testing requirements and strategy

TE.020 Develop unit test script

TE.030 Develop link test script

TE.040 Develop system test script

TE.050 Develop systems integration test script

TE.060 Prepare testing environments

TE.070 Perform unit test

TE.080 Perform link test

TE.090 perform installation test

TE.100 Prepare key users for testing

TE.110 Perform system test

TE.120 Perform systems integration test

TE.130 Perform Acceptance test

9. PERFORMACE TESTING(PT)

PT.010 - Define Performance Testing Strategy

PT.020 - Identify Performance Test Scenarios

PT.030 - Identify Performance Test Transaction

PT.040 - Create Performance Test Scripts

PT.050 - Design Performance Test Transaction Programs

PT.060 - Design Performance Test Data

PT.070 - Design Test Database Load Programs

PT.080 - Create Performance Test TransactionPrograms

PT.090 - Create Test Database Load Programs

PT.100 - Construct Performance Test Database

PT.110 - Prepare Performance Test Environment

PT.120 - Execute Performance Test

10. Adoption and Learning (AP)

AP.010 - Define Executive Project Strategy

AP.020 - Conduct Initial Project Team Orientation

AP.030 - Develop Project Team Learning Plan

AP.040 - Prepare Project Team Learning Environment

AP.050 - Conduct Project Team Learning Events

AP.060 - Develop Business Unit Managers’Readiness Plan

AP.070 - Develop Project Readiness Roadmap

AP.080 - Develop and Execute CommunicationCampaign

AP.090 - Develop Managers’ Readiness Plan

AP.100 - Identify Business Process Impact onOrganization

AP.110 - Align Human Performance SupportSystems

AP.120 - Align Information Technology Groups

AP.130 - Conduct User Learning Needs Analysis

AP.140 - Develop User Learning Plan

AP.150 - Develop User Learningware

AP.160 - Prepare User Learning Environment

AP.170 - Conduct User Learning Events

AP.180 - Conduct Effectiveness Assessment

11. Production Migration (PM)

PM.010 - Define Transition Strategy

PM.020 - Design Production Support Infrastructure

PM.030 - Develop Transition and Contingency Plan

PM.040 - Prepare Production Environment

PM.050 - Set Up Applications

PM.060 - Implement Production Support Infrastructure

PM.070 - Verify Production Readiness

PM.080 - Begin Production

PM.090 - Measure System Performance

PM.100 - Maintain System

PM.110 - Refine Production System

PM.120 - Decommission Former Systems

PM.130 - Propose Future Business Direction

PM.140 - Propose Future Technical Direction

Friday, March 7, 2008

The 'X' Factor

'X' Concept - One of my clients wanted to get a Trial Balance in the US Sets of Books which will only have Transactions which are entered in US dollars. As per the standard Oracle functionality, if the transaction currency is the same as the SOB functional currency, the Entered Dr and Entered Cr columns are not populated. Only the Accounted Dr and Accounted Cr columns are populated. This creates an issue as the client wants to run a trial balance on transactions entered only in SOB functional currency.

High Level Solution - 'X' currency, to overcome this, a solution was developed to use a currency called ‘X’ as the USD books reporting currency. If we take USD (Primary SOB) and USX (Reporting SOB), all transactions in USD in USD SOB will appear as a transaction currency in the USX SOB (foreign currency transaction). This will enable the user to run foreign currency Trial Balance in the USX books on transactions entered in USD.

Tuesday, March 4, 2008

Accounting 101 anyone?

Accounting 101 - In many occasions when I am meeting with my Client's Accounting folks, I relaize that one of the most difficult jobs is to understand and translate the accounting requirements to Oracle Accounting Processes. Here is a quick tutorial which I thought will be helpful to anybody who wants a quick understanding of the accounting concepts.

Definition - accounting is a process of recording, classifying, summarizing, analyzing and interpreting the complete financial activities of a business and communicating the results thereof to the key stakeholders . Any financial transaction should represent three basic components namely Account, Currency and Fiscal Calendar. All financial activities s need to be accounted based on Generally Accepted Accounting Principles (GAAP).

Accounting Methodologies - There are two types of accounting methodologies namely Cash Basis and Accrual Basis Accounting.

Cash Basis Accounting - Accounting entries are captured only when cash is received or paid. No entry is done when a payment or receipt is merely due.

Accrual Basis Accounting - Accounting entries are captured on the basis of amounts having become due for payment or receipt. The term Accrual in this context is recognized as Revenue when it is earned and Cost when it is incurred.

1. Accounting Rules and Concepts:

Following rules can be used t o store and process the financial activities in a typical enterprise:-

Ø Business Entity Concept (Owner’s Equity + Liability = Assets).

Ø Going Concern Concept.

Ø Money Measurement Concept.

Ø Dual Aspect Concept.

Ø Cost Concept.

Ø Accounting Period Concept.

Ø Materiality.

2. Classification of Business Transactions:

The business transactions have been broadly classified into three categories namely: -

2.1 Personal Account

It includes the accounts of persons with whom the business has dealings like customers, vendors

and bank accounts. In this scenario , the two entries of double entry book keeping will be as

follows:-

a. Debit the Receiver.

b. Credit the Payer.

2.2 Real Account

It includes the accounts of Tangible assets such as Cash A/c, Machinery A/c, Inventory, Land & Building A/c, Furniture A/c and Intangible asse ts such as Patents A/c, Goodwill A/c etc. In this scenario, the two entries of double entry book keeping will be as follows:-

a. Debit What Comes IN

b. Credit What Goes OUT.

2.3 Nominal Account

It includes accounts of all expenses, losses, incomes & gains such as salaries, rent, insurance, electricity, interest & divided received, commission received, discounts etc.

a. Debit Expenses & Losses.

b. Credit Gains & Incomes.

3. Concept of Chart of Accounts:

The Chart of Accounts is the basis of any accounting system. The Chart of Accounts is the means by which like transactions are grouped in order to collate data and generate reports. In the new Chart of Accounts, transactions will fall into five major categories:

· Income

· Expenditure

· Assets

· Liabilities

· Equity (fund balances)

In a private sector or commercial organization, equity represents shareholders funds.

4. Accrual Basis Accounting - Recording Transactions

The purpose of recording transactions is to generate information and reports used in the decision making process. By grouping like transactions over a specific time period —and matching income to expenditure over that time period—managers can monitor the financial position and performance of an organization or business unit. For instance, actual can be monitored against budget—a business unit’s financial plan—and corrective action taken if necessary.

5. Time period

A critical point in monitoring is ensuring that transactions are recorded in the correct time period. In accrual accounting, items are recorded or ‘brought to account’ as soon as they are earned or incurred.

(NOTE: In cash accounting, items are only recorded or ‘brought to account’ when actual monies are received or paid.)

Similarly, transactions are included in the financial statement for the period in which they occurred—not when monies were received.

6. Non-cash transactions

In addition, accrual basis accounting entails recording non-cash transactions such as depreciation, provisions, bad debts, etc. Non-cash transactions have a monetary value and contribute to the business unit’s financial position.

For example, a photocopier has a ‘life span’ greater than a year. It is an asset in accrual accounting terms. The initial cost of the copier is recorded as an asset in the Statement of Financial Position to recognize the ongoing benefit the copier provides to the business unit. The cost of using the photocopier is allocated across the years to the business unit or department that uses it. This cost allocation is called depreciation and is recorded as an expense in the department’s Statement of Performance. When the photocopier is replaced, the profit or loss from the sale is recorded against the department’s Statement of Performance and the accumulated depreciation is deducted from the asset account in the Statement of Financial Position. Effectively, the depreciation covers the cost of the asset and the value of the asset reduces to zero over time.

In summary, recording transactions against the correct time period and recording non –cash transactions is designed to allow the true cost of operating activities for a specific time period to be recorded and monitored. The cost of using assets and providing for accumulated leave or outstanding debts is identified and recorded.

7. Financial reports

In accrual accounting, there are three financial reports. Each report provides a set of information that assists managers in their decision -making.

7.1 Statement of Receipts and Payments

A Statement of Receipts and Payments reports the cash transactions that have occurred during the time period. It shows the actual monies received and the payments made during the time period. The Statement shows the full cost of any capital item purchased —e.g., any equipment purchases of $5000 or more. The statement presents the cash position of the business unit and allows managers to monitor that cash position.

7.2 Statement of Performance

The Statement of Performance reports the operating performance during the time period. It records the income and expenses for the period. In addition, it records non-cash transactions such as depreciation and movements in provisions. The Statement presents the financial outcome of operating activities for the period and allows managers to monitor that operating performance.

7.3 Statement of Financial Position

The Statement of Financial Position—previously called a Balance Sheet—reports the financial position of the business unit. It records the current values of the business unit’s asset and liabilities. The Statement will include accumulated depreciation on asset purchases and the provisions accumulated to meet annual and long service leave, Accounts Receivable (debtors who have not yet paid invoices raised for services delivered) and Accounts Payable (creditors who have not yet paid for their services).

8. The Accounting Doctrine

The accounting doctrine refers to accrual accounting. The accounting doctrine is designed to ensure the reliability of financial information. It is based on the assumption that the information provided by the accounting system is as good as the data entered and the parameters used to collate and summarize that data.

Parameters refer to agreed rules, methods and standards used to record transactions, summarize data and present information. The major principles that underpin the accounting doctrine are:

Consistency—transactions of the same type are always treated and recorded in the same way.

Conservatism—projections such as budgets, income, expenses, provisions, etc are based on realistic, pragmatic estimates.

Disclosure—all financial information provided is transparent; information is neither hidden nor unnecessarily complex.

Materiality—appropriate monetary values are assigned and recorded. For instance, in-kind services are not overvalued and ‘assets’ are only recorded as assets where they are of significant value.

In order to ensure that these principles are met, transactions are entered or recorded using the following conventions:

Against the correct business entity—a business unit that is distinct, owns assets and is responsible for its financial position.

At historical cost—the cost of the transaction/purchase at the time it occurred.

In the relevant period—the ‘life’ of a business entity is divided into regular accounting periods so that performance over time can be measured and assessed.

In monetary terms—all transactions are expressed in monetary values even if they are not cash transactions—e.g., provisions, depreciation, etc.

In the new finance system, consistent use of these conventions will be critical. Consistent and accurate data entry will determine whether the information in the system can be relied upon for decision making and performance monitoring.

Monday, March 3, 2008

Lockbox Reconciliation Extension

Client Industry – Applicable to all clients implementing/ implemented AR Auto Lockbox

Business Case – Client wants to be able to handle lockbox reconciliation advance cash receipts and receipt matching in EBS by reading from the receipt lines present in the electronic version of the bank statements received from the bank. Client needs an automated way to match the detailed lockbox receipts in the Oracle A/R module to the summary level deposit information processed through the BAI2 file in the Oracle Cash Management module

Solution – A custom auto lockbox reconcile extension was developed which will match the detailed lockbox receipts in the Oracle A/R module to the summary level deposit information processed through the BAI2 file in the Oracle Cash Management module. The Cash Management module matches the receipt transaction in the A/R module to the BAI2 bank statement file and creates an appropriate accounting entry in General Ledger when the amounts are different.

An additional custom form developed will store all the accounting reference into the GL Account code column for discount, charge back, bank charges item types for both lockbox and credit / debit card settlements. The Custom Lockbox Reconciliation program will derive the account and create an accounting entry in General Ledger to reconcile the receipt.

Detailed Approach - When BAI2 files are received from the Bank they are processed in the Cash Management module. The Custom Lockbox Reconciliation will match the sum of all the receipt amount for the AR receipts batch in (AR_Cash_Receipts) with the net amount received in the Bank.

On a daily basis, the lockbox reconciliation extension will process and check the bank statement transaction details and match based on the unique identifiers with receipts in Receivables, it will create an accounting in GL for difference amount of receipt from bank deposit and accounting entries for any charge.

Sunday, March 2, 2008

Summary Accounts, Parent Values and Rollup Groups

What are Summary Accounts?

• A summary account is an account whose balance is the sum of balances from multiple detail

accounts.

• Use summary accounts to perform online summary inquiries, as well as speed the processing of financial reports and Mass Allocations, and Recurring journal formulas.

• You do not enter or post transactions directly to summary accounts.

Summary Accounts Examples:

Company Segment - Summarize companies by major industry; by regions within a country; or by country group.

Cost Center Segment - Track functional areas at a detailed level but produce summary reports that group cost centers into one or more divisions.

Account Segment - Summarize your accounts by account type: Assets, Liabilities, Equity, Revenue & Expense or more detailed: Current Assets.

Detail versus Summary Accounts:

• Summary Accounts are updated when journals are posted to a corresponding detail account. They enable online summary inquiries and speed concurrent processing.

• Detail Accounts allow direct posting of business transactions and journals.

Summary Accounts versus Parent Values:

Parent Values and Rollup Groups:

About Rollup Groups:

• A rollup group is a collection of parent segment values for a given segment.

• A value cannot belong to a rollup group unless it is a parent value that has child values.

• Parent values and child values belong to the same value set, which is attached to a key flexfield

segment.